Powering Production: Exclusive Rate Discount for Manufacturers for Fiscal Year 2026

Published on: September 30, 2025

The Small Business Administration (SBA) has announced a groundbreaking change that directly benefits manufacturing clients of lenders and brokers. For the first time, manufacturers will receive fee waivers on both the SBA 7(a) and 504 loan programs, effective October 1, 2025.

These changes, part of the White House’s “Made in America initiative”, will empower more small manufacturers (NAICS 31-33) with the capital needed to boost hiring, expand operations, and drive production.

As your SBA lending partner, we want to ensure you have the latest information to help your manufacturing clients leverage these benefits and grow their businesses.

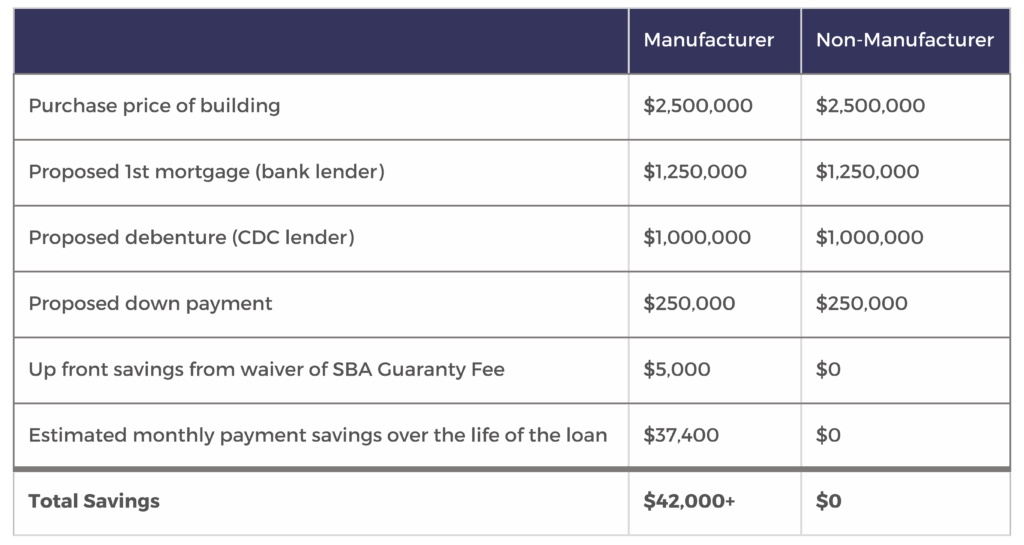

How the SBA Has Changed 504 Loan Fees for Manufacturers

The 504 program has always been a strong option for financing real estate and equipment. With the new fee relief, it’s even more compelling.

Upfront & Annual Fee Waivers

What’s New: For all 504 loans to manufacturers, including refinances, both the upfront SBA guaranty fee and the annual SBA servicing fee are reduced to 0%.

What It Means: Manufacturers can now acquire or improve major fixed assets with no SBA-related guaranty fees for the entire life of the loan.

Example – SBA 504 Loan Comparison

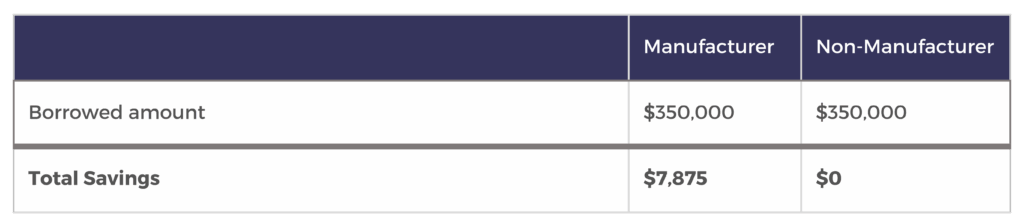

How the SBA Has Changed 7(a) Community Advantage Loan Fees for Manufacturers

The SBA has also revised fees for 7(a) loans, including the Community Advantage program, making them more affordable than ever for manufacturers.

Upfront SBA Guaranty Fee Waiver

What’s New: For 7(a) loans of $950,000 or less to manufacturers, the upfront SBA guaranty fee is now 0%, including under the Community Advantage program.

What It Means: This removes a significant cost barrier for manufacturers seeking access to working capital, equipment, or other financing. Eliminating upfront fees helps clients preserve more cash for day-to-day operations and growth.

Example – SBA 7(a) Loan Comparison

At Mountain West Small Business Finance, we’re committed to helping our lending partners confidently navigate these changes and secure the most effective financing solutions available for their clients. With over 80 years of combined lending experience, our expert team is ready to answer any questions you or your clients may have. Reach out today!