Welcome to

Mountain West Small Business Finance

Our lending and entrepreneurial education programs empower small business owners to succeed.

Building

Get a 10, 20, or 25-year fixed-rate commercial building loan.

Equipment

Buy your equipment with a 10 or 20-year fixed-rate loan.

Working Capital

Jumpstart your business with $50,000 – $350,000 to cover expenses.

About Us —

Mountain West

Small Business Finance

Is a private, non-profit corporation licensed and regulated by the U.S. Small Business Administration. Mountain West administers the SBA’s 504 Development Company Loan Program in the state of Utah and in surrounding mountain states.

![]()

We’re Utah’s biggest SBA lender you’ve never heard of.”

John D. Evans

Chief Executive Officer

Mountain West Small Business Finance

5.72%

25-Year Rate

5.78%

20-Year Rate

5.61%

10-Year Rate

5.72%

25-Year Refi Rate

5.78%

20-Year Refi Rate

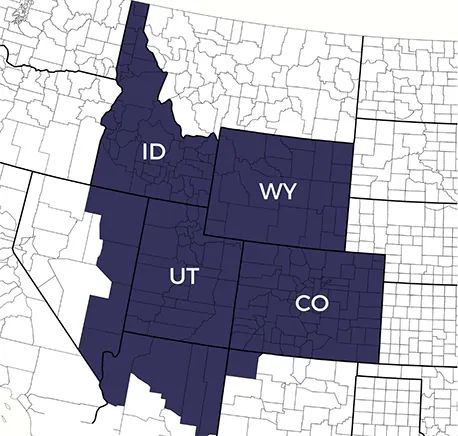

—Service Area —

Where We Lend

| Salt Lake Valley: | 2595 East 3300 South Salt Lake City, UT 84109

801.474.3232 |

| Central Utah & Colorado: | 741 North 530 East Orem, UT 84097

801.221.7772 |

| Southern Utah, Arizona & Nevada: | 107 South 1470 East, Ste. 104 St. George, UT 84790

435.652.3761 |

| Wyoming: | 307.677.5404 |

—Latest News & Blog —

From Our Blog

Mountain West Foundation Inducted into Utah Black Chamber Hall of Fame

On Friday, February 13, 2026, MWSBF had the honor of attending the 4th annual Mardi Gras in the Mountains hosted by the Utah Black Chamber of Commerce. This year, the Mountain West Foundation...

Viva Las Evans: A Celebration of John Evans and his 30 Years of Service

After nearly 30 years of dedicated service, John Evans, President and CEO of Mountain West Small Business Finance, began a well-earned retirement in November, 2025. We got to celebrate John and his...

Behind the Door of Beacon Metals

Published on: December 2, 2025 You will never meet someone as passionate about doorknobs as Chad Riches, the President and third-generation owner of Beacon Metals. It’s actually the whole door he’s...

—Testimonials —

What Our Customer Says

When we started, there weren’t a lot of properties in Springdale available for purchase. But through a remarkable set of events that centered around the pandemic, our landlord finally told me that we ought to buy the property. I almost fell off my chair. It was something we had always wanted to do, but I had a feeling the price would be too high. He showed me how to do it through a 504 loan. I hadn’t known anything about 504s prior to that, but I called my bank the next day. They looked at the numbers and thought it made sense.

We started the loan process and began to meet with a representative from Mountain West, who was the expert on packaging our business to the SBA. That was a real gift. I felt like we had a real advocate there. In the end, it was a fairly easy process because Mountain West did all the heavy lifting. And for us, our loan changed everything. The 504 is exactly the product we needed to get to the next level.

Rick Praetzel

Owner, Zion Adventure Company

The two things that can either help or hinder us from growing are our banking partners and finding good employees. We’ve been blessed in both areas. We’ve had several SBA loans and they always go smoothly because of how well our bank, Cache Valley Bank, and Mountain West Small Business Finance work together. It’s truly like we’re working with just one institution. It goes back to service. I could go to many different places to get a loan, but these two make it so easy.

Brandon Burt

Owner, Burt Brothers

We saw that a building close to our restaurant was available and thought it would be a great spot for our new business. We had enough money for a down payment, so we went to our local bank to ask about getting a loan. They wanted to help, but starting a restaurant-related business in the time of COVID was deemed too risky, so they put me into contact with Mountain West to see about getting an SBA loan. From there, the process was fairly easy. Mountain West made everything really convenient.

Ken Ulzibayar

Owner, Summit Restaurant Supply

We are very excited about our new facility. It will not only be a warehouse for our restaurant supplies, but we will also use some of the space as a showroom to display our products. The building also has enough room that we may carve out some space to open another restaurant down the road.

Amy Erdenebileg

Owner, Summit Restaurant Supply

My dad taught me a very young age that the seed we sell is really no different from the seed the guy on the street sells. What sets us apart is how well we take care of people. I took that to heart and have always taken an active interest in our clients. People want to know that there’s somebody out there listening to them, believing in them.

Jason Stevens

Owner, Maple Leaf Company

—Staff —

Meet Our Team

John Evans

Chief Executive Officer

Spencer Davis

President

Danny Mangum

Executive Vice President